Andrew Gosse

Sales Representative

Mobile: 709.682.0550

Phone: 709.579.8106

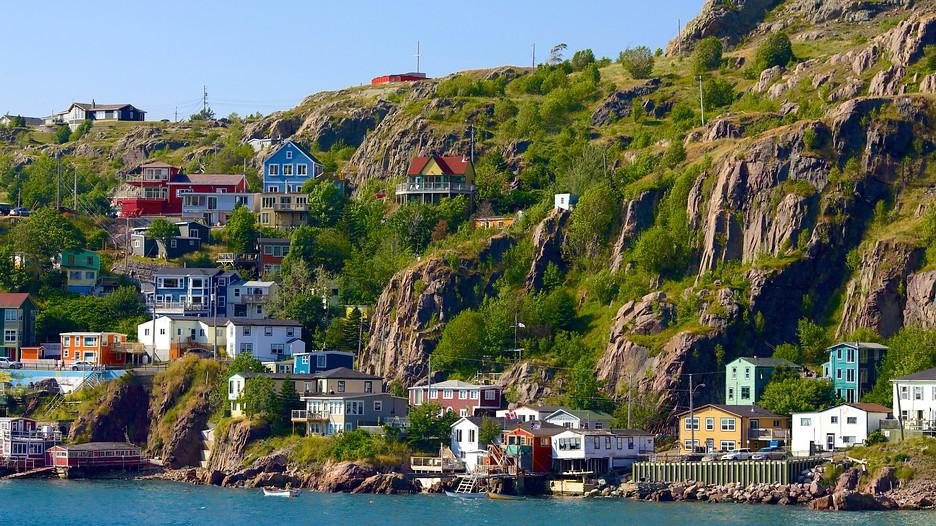

St. John's & Metro Newfoundland Real Estate Since 1994

Information Request

Create your Client Portal account or sign in to favourite listings, save searches and sign up for automatic email notifications.